Your organization is probably 60 times more unsafe than you think!

Our Employee Screening platform enables you to select the right candidates, involving much less cost and time. With Gravity Integrates you are assured of dedicated Software Platform, Mobile Applications to have real time access & tagged geo locations. We have a strong network and dedicated SPOC.We commit quality verification with accurate analysis in shortest time.Quality verifications & shortest TAT with accurate analysis.

GI Advantage-

Our Employee Screening platform enables you to select the right candidates, involving much less cost and time. With Gravity Integrates you are assured of

- Complete Dedicated Software Platform & Mobile Applications to have real time access & tagging geo locations.

- Quality verifications & shortest TAT with accurate analysis.

- Strong network.

- Dedicated SPOC for each client.

Understanding the criticality of maintaining human capital, reflecting integrity and commitment, we drive ourselves to help you make qualified decisions at the professional hiring stage. The final ramifications of such a process would save you the time and effort spent in investing resources that would otherwise be constructively implemented in another part of your business. Human resources is all about making the right decisions from recruitment to process implementation and GI helps you take these decisions with the level of employee verification information that can lead your business on the path to competitive growth.

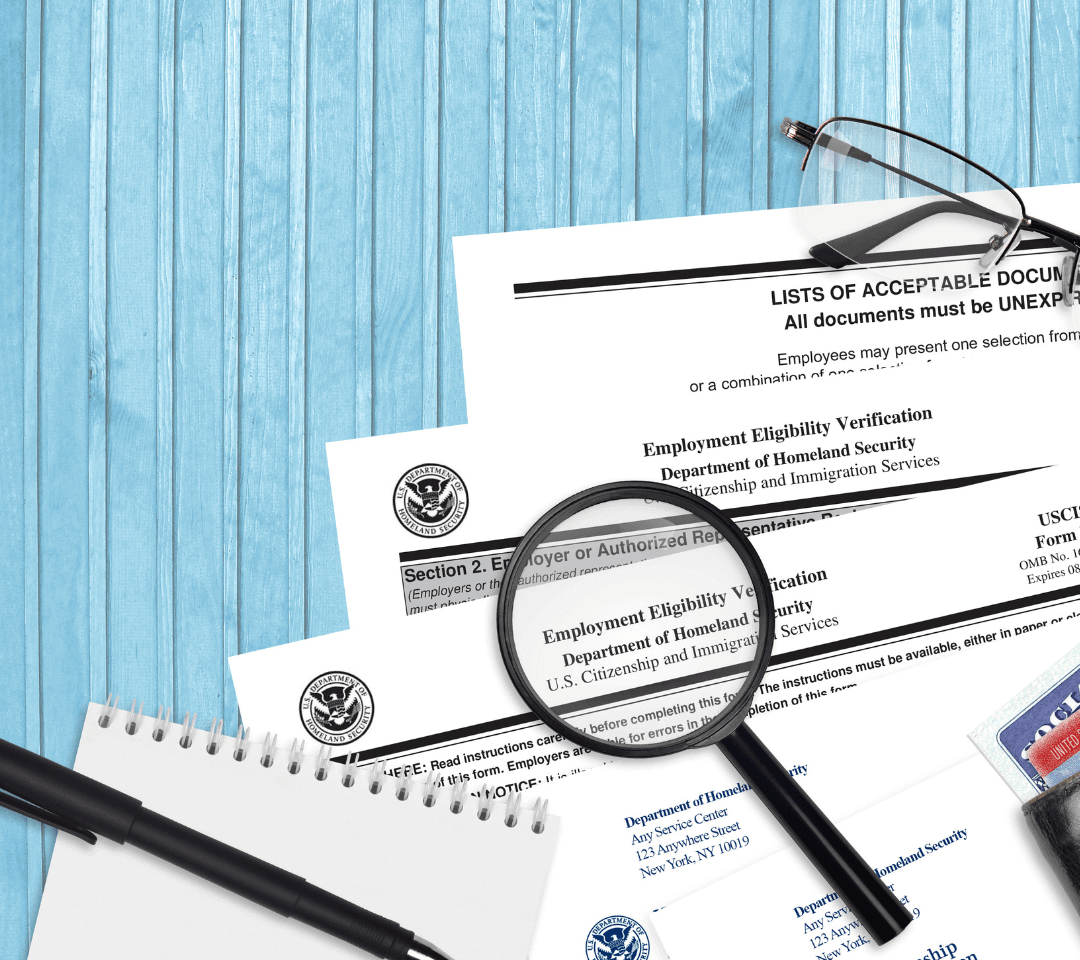

Employee Verifications

“Never judge a book by its cover.”

In terms of recruitment, it means something very unique. When it comes to selecting the best candidates to work for your business, going deeper than just the face value should be a routine practice.

Save your Organization, Verify Employees Before Hiring!

About one-third of job applications in Asia Pacific in 2014 contained a lie or a discrepancy

First and foremost, in a more competitive job market, individuals are more apt to Camouflage or hide certain aspects of their history in order to appear more attractive to the recruiters. While some of these actions are fairly obvious to the trained recruiter, not all will be easy to spot until the background check takes place. A background check should include all of these elements:

“Slowly but steadily, India is showing an increasing trend of discrepancy or fraudulent cases.”

- Highest numbers of discrepancies, 2 out of 3, are found in employment verification, in the areas of false tenure, title, and salary data coupled with fake experience documents.

- Next up on the list are discrepancies found in education (5-25%) and address (15-20%) verifications.

- Criminal check or Court Record check.

Why the Background Check is Important?

Fortunately, background screening and criminal background checks are available to recruiters and human resources professionals. Employers today have the right to learn more about the candidates they are about to commit to a legal relationship with. They also have the right to ensure that a potential new hire does not have anything lurking in their past that could potentially harm the business or create a safety hazard for clients and other employees.

For any organization to grow, it is imperative to hire the right candidate. Given the fact that misconduct and fraud are possible threats when it comes to hiring, companies have become extremely cautious. Thus employee screening plays a crucial role in verifying the background of the candidates and enable organizations take the correct decision.

- To identify the adverse claims behavior

- To identify the nexus if any, between any hospital and agent / client or other intermediary

- To confirm hospital eligibility as per the policy conditions

- To control prolonged hospitalizations and over-billing / over stay

- To identify good hospital who are willing to work on reasonable SOC under TPA network of hospitals

- To synchronize and educate hospitals / patients to utilize the policy in proper manner

- To find frauds and misrepresentations

- To find pre-existing ailments, OPD converted into IPD

- To find authenticity of claim submitted.

Know Your Customer (KYC)

KYC Stands for “Know Your Customer”

Know your customer (KYC) policy is an important step developed globally to prevent identity theft, financial fraud, money laundering and terrorist financing. The objective of KYC is to enable banks, Telecom sectors, NBFc’s & other institutions to know and understand their customers better and help them manage their risks prudently.

KYC is a regulatory and legal requirement and KYC policies are framed by respective organisations incorporating the key elements following the Reserve Bank of India’s directives & their own requirements.

The process of KYC entails identifying the customer and verifying the identity by using reliable and independent documents or information.

KYC could be check on following 3 levels :-

1. Identity Check 2. Integrity Check 3. Address check

Following Documents come under scanning while doing KYC by GI. All or some as per requirements are verified :-

1. Pan Card

2. Passport

3. Aadhar Card-UID

4. Driving License

Identity of a Firm/company/ legal entity can be confirmed by verifying the following documents :-

1. Public/Private Limited-Certificate of Incorporation

2. Partnership Firm-Partnership deed along with identity proofs of the partners.

3. Proprietorship Firm- Identity proof of the proprietor.

GI Advantage :-

1. PAN INDIA Coverage

2. Access to many fraudulent/money laundering databases

3. IT /Mobile App enable services.

Vendor Verification

Vendor Verifications is a procedure that ensures your current and future vendors comply with policies related to your company. In current economy, business reputation is the key factor to get recognized in the fast paced business arena. Every business who wants to reach the highest point of development is outsourcing their tasks to third party i.e., Vendors.According to a recent global study, corporate fraud has increased manifold over the last two years, despite significant investment in internal corporate controls, and other corrupt practices acts. The study also noted that most corporate frauds were detected by accidental means. Business dealings are always extremely sensitive. Each transaction needs to be dealt with a lot of study and caution. Entering into long-term relationships with customers and vendors require a deep understanding of the people you deal with. Often, contracts are signed between businesses for a long period, counted in years. Hence, it is important to know whom you are dealing with. It helps in making well-informed decisions while selecting a potential vendor, and minimizes the risk of exposing oneself to future problems of ignorance.According to a recent global study, corporate fraud has increased manifold over the last two years, despite significant investment in internal corporate controls, and other corrupt practices acts. The study also noted that most corporate frauds were detected by accidental means. Business dealings are always extremely sensitive. Each transaction needs to be dealt with a lot of study and caution. Entering into long-term relationships with customers and vendors require a deep understanding of the people you deal with. Often, contracts are signed between businesses for a long period, counted in years. Hence, it is important to know whom you are dealing with. It helps in making well-informed decisions while selecting a potential vendor, and minimizes the risk of exposing oneself to future problems of ignorance.

When you choose to supply goods or services to a company, you need to be aware of their past performance trends, history and reputation. Who you deal with, will ultimately have an impact on your company. A vendor verification process is essential to prevent frauds. Without proper vendor verification process in place, small mistakes can have big consequences like:

1. Lawsuits and Litigation liability.Lawsuits and Litigation liability.

2. Potential Financial fraud and abuse problem.

3. Financial failure leading to unfulfilled contractual obligations.

4. Serious Reputation Damage.

Vendor selection process and vendor verification from GI will help save your business and reputation by knowing the following facts of vendors

1. Bankruptcy, Lien, Collections, & Judgment Check

2. Insurance Verification / Certificate Management

3. Professional License Verification

4. Reputational risk inquiry includes the retrieval of company filing, directorship details, annual tax returns.

5. Online and Offline media check of the company and individuals

6. Address verification to check the existence of the company, size of the business.

7. Reference Checks to inquire previous partnership details and reputation.

GI will perform your vendor screening and verify that their business information is valid, up to date and your vendor compliance policy and procedures are followed.

If you haven’t already, now is the time to find a trusted advisor, understand your risks and put intelligent plans in place to deal with vendor fraud risks, or any other factors that will interrupt your business and hurt your reputation, because reputation is the only thing which once gone, means it will never come back to you again.

With a proper understanding of the risks and rewards involved, a vendor due diligence and Vendor verification process can add value to a business in a very great manner. It can save time, money and in some cases the deal whilst being the best shield against transaction risks.